Consumers are adopting stand-alone broadband services at a much higher rate than just two years ago, and analysts predict that the economic downturn prompted by the COVID-19 outbreak will accelerate the trend.

Why it matters: With a recession looming, consumers may look to cut pay TV service in favor of more robust standalone internet packages once they’re free to leave their homes.

Why it matters: With a recession looming, consumers may look to cut pay TV service in favor of more robust standalone internet packages once they’re free to leave their homes.

What they’re saying: “It’s obviously a fine line because people are going to be watching all their pennies,” said Steve Nason, director of research at Parks Associates, a market research firm based in Dallas.

“Entertainment services are sometimes some of the last things to go because it’s a departure from their daily struggles,” he said. “But it’s become easier on the video side, because all you really need is a broadband connection.”

While cord-cutting has stabilized during the pandemic, pay TV services are still being replaced by over-the-top streaming apps, which require strong broadband connections.

“Residential broadband demand has never been higher,” says Neil Begley, SVP/senior analyst at Moody’s.

With many live sports being cancelled for the foreseeable future, consumers may have less incentive to hang onto their expensive pay TV packages.

“I think sports being cancelled will definitely add to cord-cutting,” says Alan Wolk, co-founder and lead analyst at TV[R]EV. Loyal fans will want regional sports networks to watch their favorite teams, Wolk said. “The ESPN audience, people who are fans of sports in general, will likely decide they can watch somewhere else if and when the NFL returns — the cost is going to be way too high.”

Be smart: The broadband boom driven by the pandemic is likely to continue even after the virus dies down.

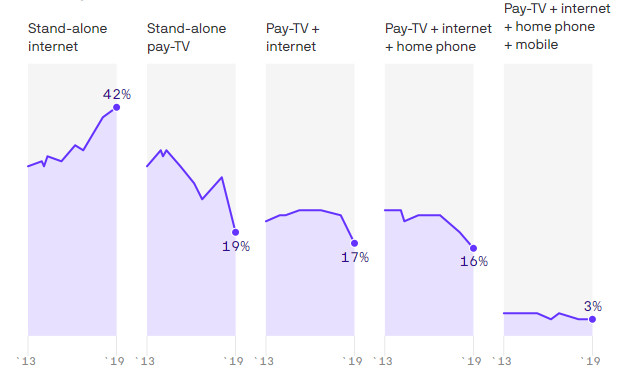

Most households need broadband to do work and home-school tasks virtually. Now that schools and workplaces have learned to adopt remote measures, experts predict more of those functions will continue to be conducted remotely. So far, Comcast and Verizon have reported over 30% and 20% increases in broadband usage, respectively, since the beginning of the pandemic. Streaming video usage has shot up dramatically in the U.S. over the past month. The pandemic has changed user behavior to promote more binge-watching, a habit that’s likely to persist after the crisis. By the numbers: After holding steady for five years, household adoption of stand-alone internet service rose to 42% in the third quarter of 2019, up from 34% in 2017, according to Parks Associates.

The rise was largely driven by subscribers aged 18-24, who subscribe to stand-alone internet at a rate that is double that of older consumers. 45% of over-the-top video subscribers have an internet-only package, up from 39% in 2017.

The average stand-alone internet subscriber pays $60 a month, a 36% increase since 2013. The traditional broadband, phone and pay TV bundle was in trouble even before the pandemic.

Consumers continue to drop their wired phone lines in favor of wireless everything. They generally purchase stand-alone wireless subscriptions in order to customize their data plans and features. Free streaming is on the rise. “I do think this (coronavirus) is going to lead to a lot of unbundling and cord cutting,” says Wolk. “People are finding that the FASTS (free ad-supported streaming TV services) have all the programming they need for now, including news and sports.”

The big picture: Over a decade ago, telecom providers started to bundle their services together to increase average revenue per user. A “double-play” bundle often included internet and pay TV like cable or satellite, while a “triple-play” bundle typically included internet, TV and phone service.

What to watch: Now telecom companies are interested in bundling broadband service with over-the-top video services, but will need to offer a compelling value-add to consumers who are now used to buying services a-la-carte.

The combined monthly cost of streaming services that younger generations are subscribing to is beginning to approach what it costs to subscribe to traditional cable or satellite pay TV service. “Boomerang households” could come back to the bundle. They may opt for a bundled package of internet and pay TV if the provider offers steep discounts. Yes, but: Not all firms will have the ability to capitalize on the trend. Satellite companies like AT&T’s DirecTV and Dish, which also provide pay TV services, do not have the same broadband strength to fall back on as their ISP counterparts like Verizon and Comcast.

“At AT&T, now just over half of its business is being very exposed to a recession,” says Jonathan Chaplin, an analyst and Managing Partner of New Street Research. “Wireless is the one piece of their business that’s OK, but pay TV is declining at a much faster rate and satellite is not.